All Categories

Featured

Table of Contents

Most contracts allow withdrawals below a defined degree (e.g., 10% of the account worth) on a yearly basis without abandonment charge. Accumulation annuities normally provide for a money repayment in the occasion of fatality prior to annuitization.

The contract may have a mentioned annuitization date (maturity day), yet will usually permit annuitization at any moment after the very first year. Annuity income options listed for prompt annuities are generally likewise available under delayed annuity contracts. With an accumulation annuity, the contract proprietor is claimed to annuitize his/her buildup account.

How do I get started with an Annuities For Retirement Planning?

You can make a partial withdrawal if you need added funds. On top of that, your account value remains to be kept and credited with existing interest or investment earnings. Certainly, by taking regular or organized withdrawals you run the risk of diminishing your account worth and outlasting the agreement's accumulated funds.

In a lot of contracts, the minimal rate of interest is established at issue, however some contracts allow the minimal price to be readjusted regularly. Excess rate of interest contracts give versatility with respect to premium payments (solitary or flexible) (Lifetime income annuities). For excess rate of interest annuities, the optimum withdrawal charge (additionally called a surrender charge) is capped at 10%

A market price adjustment readjusts an agreement's account value on surrender or withdrawal to mirror adjustments in rate of interest given that the invoice of agreement funds and the staying period of the rate of interest assurance. The adjustment can be positive or adverse. Immediate annuities. For MGAs, the optimum withdrawal/surrender fees are shown in the following table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later7%6%5%4%3%2%1%0%Like a certificate of down payment, at the expiry of the assurance, the accumulation amount can be restored at the business's new MGA rate

Why is an Secure Annuities important for long-term income?

Unlike excess passion annuities, the quantity of excess interest to be credited is not known up until the end of the year and there are generally no partial credit reports throughout the year. Nevertheless, the technique for figuring out the excess rate of interest under an EIA is identified in development. For an EIA, it is very important that you understand the indexing attributes made use of to identify such excess passion.

You ought to additionally recognize that the minimum floor for an EIA differs from the minimum floor for an excess interest annuity. In an EIA, the floor is based upon an account worth that may credit a lower minimum interest price and might not attribute excess interest annually. Furthermore, the optimum withdrawal/surrender costs for an EIA are set forth in the complying with table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8Year 9Year 10Year 11 and Later10%10%10%9%8%7%6%5%4%3%0% A non-guaranteed index annuity, additionally commonly referred to as an organized annuity, signed up index linked annuity (RILA), barrier annuity or floor annuity, is a buildup annuity in which the account value increases or reduces as figured out by a formula based upon an external index, such as the S&P 500.

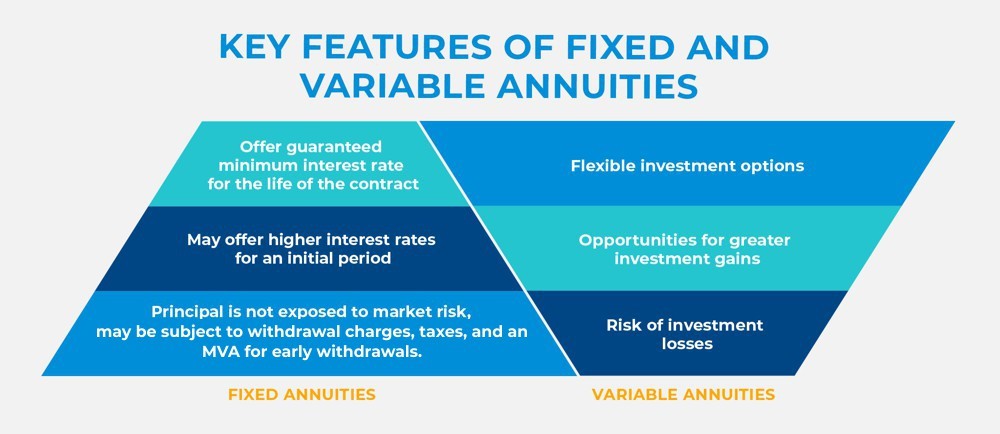

The allocation of the amounts paid into the agreement is generally chosen by the proprietor and might be changed by the owner, subject to any type of contractual transfer restrictions (Tax-deferred annuities). The following are necessary functions of and considerations in buying variable annuities: The agreement holder births the financial investment threat linked with properties held in a separate account (or sub account)

Withdrawals from a variable annuity might undergo a withdrawal/surrender fee. You should know the size of the fee and the length of the abandonment cost duration. Starting with annuities marketed in 2024, the optimum withdrawal/surrender costs for variable annuities are set forth in the complying with table: Year 1Year 2Year 3Year 4Year 5Year 6Year 7Year 8 and Later8%8%7%6%5%4%3%0%Demand a duplicate of the program.

Retirement Annuities

The majority of variable annuities consist of a death advantage equivalent to the higher of the account worth, the premium paid or the highest anniversary account value. Many variable annuity agreements provide ensured living advantages that supply an ensured minimum account, earnings or withdrawal benefit. For variable annuities with such guaranteed advantages, consumers should know the charges for such advantage assurances in addition to any limitation or constraint on financial investments choices and transfer rights.

For repaired deferred annuities, the benefit rate is contributed to the rates of interest stated for the very first contract year. Know just how long the bonus offer rate will be credited, the rates of interest to be credited after such perk rate duration and any kind of surcharges attributable to such incentive, such as any higher abandonment or mortality and expense fees, a longer surrender cost duration, or if it is a variable annuity, it may have a bonus offer regain cost upon death of the annuitant.

In New york city, representatives are required to give you with comparison forms to assist you decide whether the substitute is in your finest interest. Know the consequences of replacement (brand-new abandonment cost and contestability duration) and make certain that the new item fits your present needs. Watch out for replacing a postponed annuity that could be annuitized with an instant annuity without comparing the annuity settlements of both, and of changing an existing contract solely to get an incentive on another item.

Income tax obligations on rate of interest and investment incomes in postponed annuities are delayed. Nevertheless, as a whole, a partial withdrawal or surrender from an annuity before the owner gets to age 59 is subject to a 10% tax penalty. Unique care needs to be taken in roll-over scenarios to avoid a taxed event. Annuity products have come to be progressively intricate.

What should I look for in an Annuity Withdrawal Options plan?

Generally, insurance claims under a variable annuity contract would be satisfied out of such separate account possessions. If you purchase a tax obligation competent annuity, minimum distributions from the contract are called for when you get to age 73.

Only acquisition annuity products that match your requirements and objectives and that are suitable for your financial and household scenarios. See to it that the agent or broker is accredited in excellent standing with the New york city State Department of Financial Providers. The Division of Financial Solutions has actually taken on policies needing representatives and brokers to act in your best passions when making referrals to you associated to the sale of life insurance policy and annuity products.

Watch out for a representative who recommends that you sign an application outside New york city to buy a non-New York item. Annuity items approved for sale in New york city generally supply greater consumer securities than items sold elsewhere. The minimal account values are higher, charges are reduced, and annuity repayments and survivor benefit are much more beneficial.

How do Income Protection Annuities provide guaranteed income?

In the process, that development can potentially experience development of its own, with the gains compounding with time. The possibility to attain tax-deferred growth can make a significant difference in your revenue in retirement. For instance, a $100,000 purchase repayment compounded at a 5% price each year for twenty years would certainly grow to $265,330.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Defining the Right Financial Strategy Pros and Cons of What Is Variable Annuity Vs F

Decoding Fixed Vs Variable Annuities A Comprehensive Guide to Fixed Index Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why

Understanding Fixed Index Annuity Vs Variable Annuity A Closer Look at Fixed Income Annuity Vs Variable Annuity Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Pros And Co

More

Latest Posts